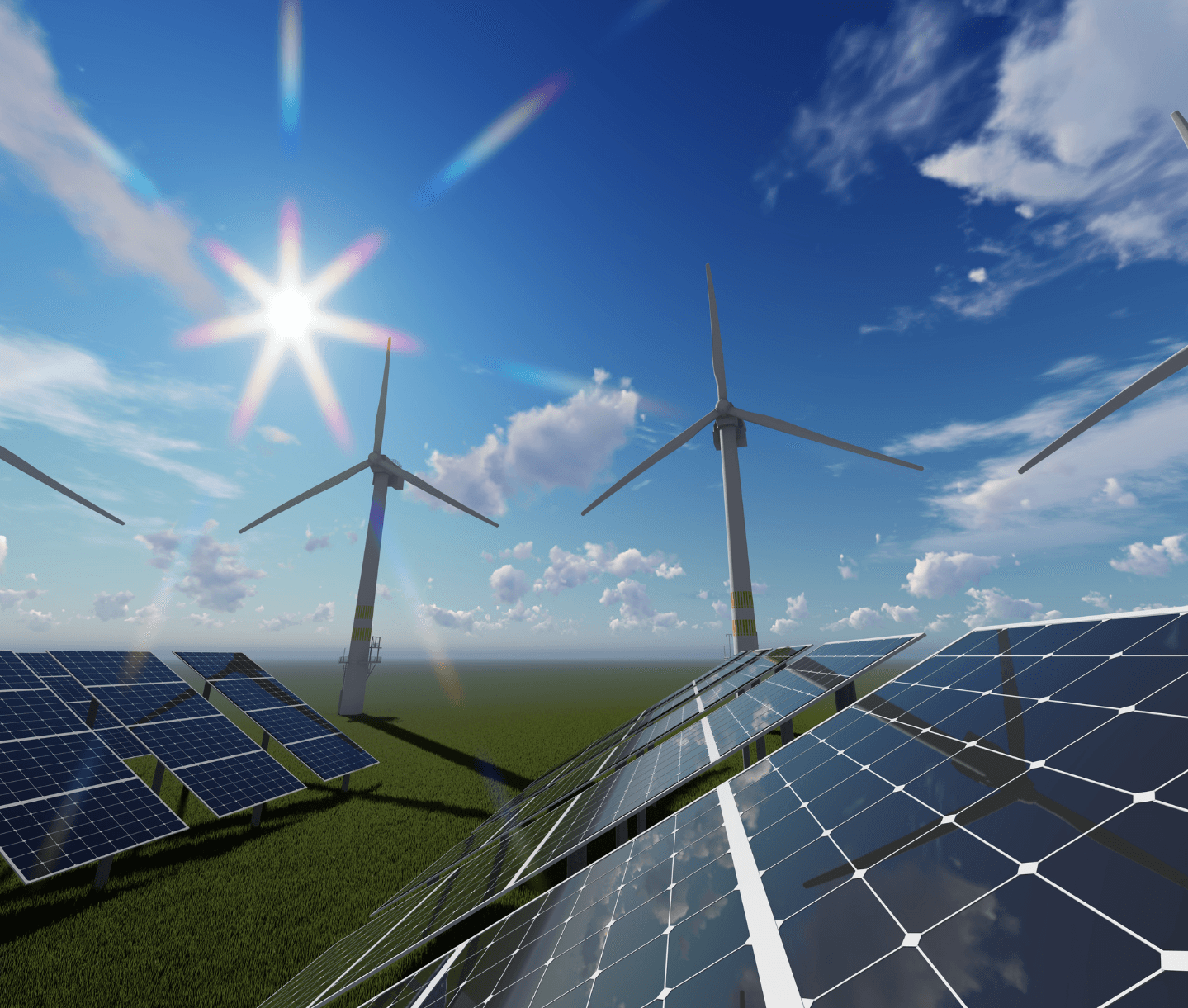

In recent years, solar power has become a leading renewable energy option, offering environmental benefits and economic advantages. As we step into 2024, it's crucial to understand the economics of solar energy in the UK, covering cost trends, returns on investment (ROI), and available financial incentives.

Cost Trends

The decreasing cost of solar power is a major driver behind its increasing adoption. Over the past decade, solar panel prices have dropped significantly, making solar energy more accessible to homeowners and businesses. In 2024, this trend continues, with solar panel costs reaching new lows. Technological advancements, economies of scale, and heightened competition in the solar industry all contribute to this downward cost trajectory.

Installation costs have also been reduced due to streamlined processes and improved efficiency in solar panel manufacturing. Consequently, the initial investment required for installing solar systems has become more manageable, enhancing the economic viability of solar power.

ROI (Return on Investment)

Investing in solar energy offers attractive returns, both financially and environmentally. ROI, a primary financial metric, compares the gains from an investment to its cost.

In the UK, homeowners and businesses can expect favorable ROI from solar installations. With declining panel costs and government incentives, the payback period for solar investments has significantly shortened. In many cases, solar system owners can recoup their initial investment within a few years and benefit from decades of nearly free electricity from the sun.

Additionally, solar panels typically come with warranties of 20 to 25 years, ensuring long-term performance and reliability. This extended lifespan contributes to the financial attractiveness of solar investments.

Financial Incentives

Various financial incentives are available in the UK to promote solar energy adoption. The Feed-in Tariff (FiT) scheme, despite undergoing changes, provides payments to homeowners and businesses for the renewable electricity they generate, including solar power.

The Smart Export Guarantee (SEG) ensures that solar energy producers receive payments for surplus electricity exported to the grid. Electricity suppliers must offer fair and transparent export tariffs under this scheme, enhancing the financial returns of solar investments.

Additionally, tax incentives like the Renewable Heat Incentive (RHI) for solar thermal systems offer further financial benefits to eligible participants.

In 2024, the economics of solar power in the UK are highly compelling. With decreasing costs, attractive ROI, and various financial incentives, solar energy presents a lucrative opportunity for homeowners and businesses to cut energy bills, reduce their carbon footprint, and contribute to sustainability.

As technology advances and policy support for renewables strengthens, solar power is set to play an increasingly significant role in the UK's energy landscape, driving economic growth, job creation, and environmental stewardship.